CPI Migration Guide

1. What is changing?

Several years ago we moved a number of our customers from our legacy payment gateway to a new payment system. As part of this original migration we provided customers with the option of continuing to use the legacy hosted payment page – referred to as the ‘CPI’ (Cardholder Payment Interface) - via an emulator. Simply put, this allowed our customers to continue using their old/existing ePDQ integration without needing to update that integration.

The ‘CPI emulator’ will be deprecated on 31 July 2021, meaning it will no longer usable for accepting online payments after this date. This is primarily because the CPI Emulator is unable to support a number of the new regulatory changes affecting all payment gateways and online businesses as part of the Payment Services Directive (PSD2) regulatory and compliance changes coming into effect in 2021.

2. Why am I receiving this message?

According to our records, we believe you are processing your online transactions via the CPI emulator (i.e. your current ePDQ integration uses this version of the payment page). This is either because we have direct evidence showing the CPI being used, or you have an ePDQ account that has this method as the primary integration option, but have not transacted recently enough for us to determine what integration method you are using.

3. What do I need to do?

If you are still using the CPI payment page as part of your online transaction process, you will need to reintegrate to a supported solution before 31 July 2021. You will need to engage with your web developer, IT team or potentially your shopping cart plugin provider to determine how to achieve the necessary integration updates.

If you do use a plugin to link your shopping cart system to ePDQ via the CPI, we would recommend contacting your plugin provider to ascertain whether a suitable updated version is available.

4. How do I know if I am using the CPI emulator?

You can determine which integration version you are using by checking which payment page appears as part of the transaction process on your website.

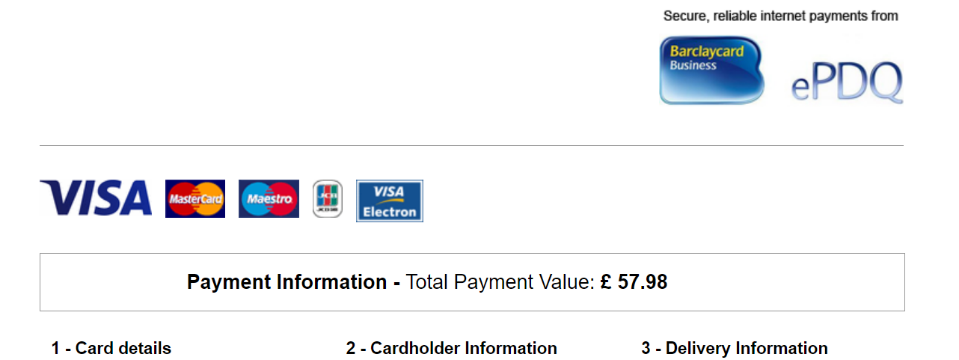

If your payment page looks like this:

And/or the URL of the payment page looks like this: https://secure2.epdq.co.uk/cgi-bin/CcxBarclaysEpdq.e

…then this would indicate you are using the CPI emulator and will need to update your integration.

If your payment page does not look like this, it would imply you have already reintegrated to a current/supported solution.

If in doubt, please consult your web developer.

5. What options are available?

As a user of the CPI, it is likely you will want to integrate to a similar ‘hosted’ solution. By ‘hosted’ we mean that we host the payment page on your behalf, and you redirect customers to that hosted payment page to enter their card details.

The Hosted Payment Page integration method instructions can be found here

https://support.epdq.co.uk/integration-solutions/integrations/hosted-payment-page

Please ensure that, as part of any reintegration, you consider the various card scheme and PSD2 regulatory requirements coming into play this year. For example, you may not currently use 3D Secure (3DS), but this will be mandatory as of September 2021.

If you reintegrate using the eCommerce solution then 3DS will automatically be invoked as part of the cardholder journey. As part of the PSD2 mandates, 3DS version 2 will soon be available on ePDQ. It is recommended that any integration you perform should include all of the additional data relevant to 3DS version 2. Full details are included in the aforementioned integration guides.

6. Technical information – reintegration options for Hosted Payment Page (HPP)

This integration method is the one closest to your existing CPI Integration – Barclaycard hosts the payment page on your behalf and you redirect the cardholder to our securely hosted payment page to enter their card details.

The integration process requires you to use SHA Hashing to ‘encrypt’ the transaction parameters prior to redirecting the cardholder to the HPP.

This hashing will take place on your server, and utilises common coding practices to encode this data before submission from your website to the ePDQ payment page.

https://support.epdq.co.uk/en/integration-solutions/integrations/hosted-payment-page#e_commerce_integration_guides_security_pre_payment_check

The payment page can be customised if you wish to add your own colours. logos and fonts etc.

https://support.epdq.co.uk/en/integration-solutions/integrations/hosted-payment-page#e_commerce_integration_guides_payment_page_look_and_feel

Transaction feedback (the status of the transaction after authorisation has been requested etc.) can be returned to you via a browser redirect as well as via a server to server post, similar to how the CPI works.

https://support.epdq.co.uk/en/integration-solutions/integrations/hosted-payment-page#e_commerce_integration_guides_transaction_feedback

There is some basic sample code available on the link below. Please note this code is for demonstration purposes only, and will need to be modified according to your own data requirements and ePDQ account details:

https://www.barclaycard.co.uk/business/accepting-payments/developer-solutions/resources

If you wish to test your new integration away from your live ePDQ account, you can set up a trial ePDQ account here:

https://mdepayments.epdq.co.uk/Ncol/Test/BackOffice/accountcreation/create?ISP=epdq&acountry=gb